- #Freeze my credit how to

- #Freeze my credit password

Placing a credit freeze with each of the three major agencies, Equifax, Transunion, and Experian, offers the most protection. A credit freeze is perhaps the most effective way of stopping identity thieves from opening new accounts in your name.

#Freeze my credit how to

(For more detailed information, see “ How to Unfreeze Credit for Free.A credit freeze, also called a security freeze, prevents a credit reporting agency from releasing your credit report to others, without affecting your credit score. I temporarily unfroze my credit twice, each time in a single-digit number of minutes, whereas many of my respondents spent hours or days on this task.

#Freeze my credit password

This is where the “careful, secure password and PIN records” come in handy.

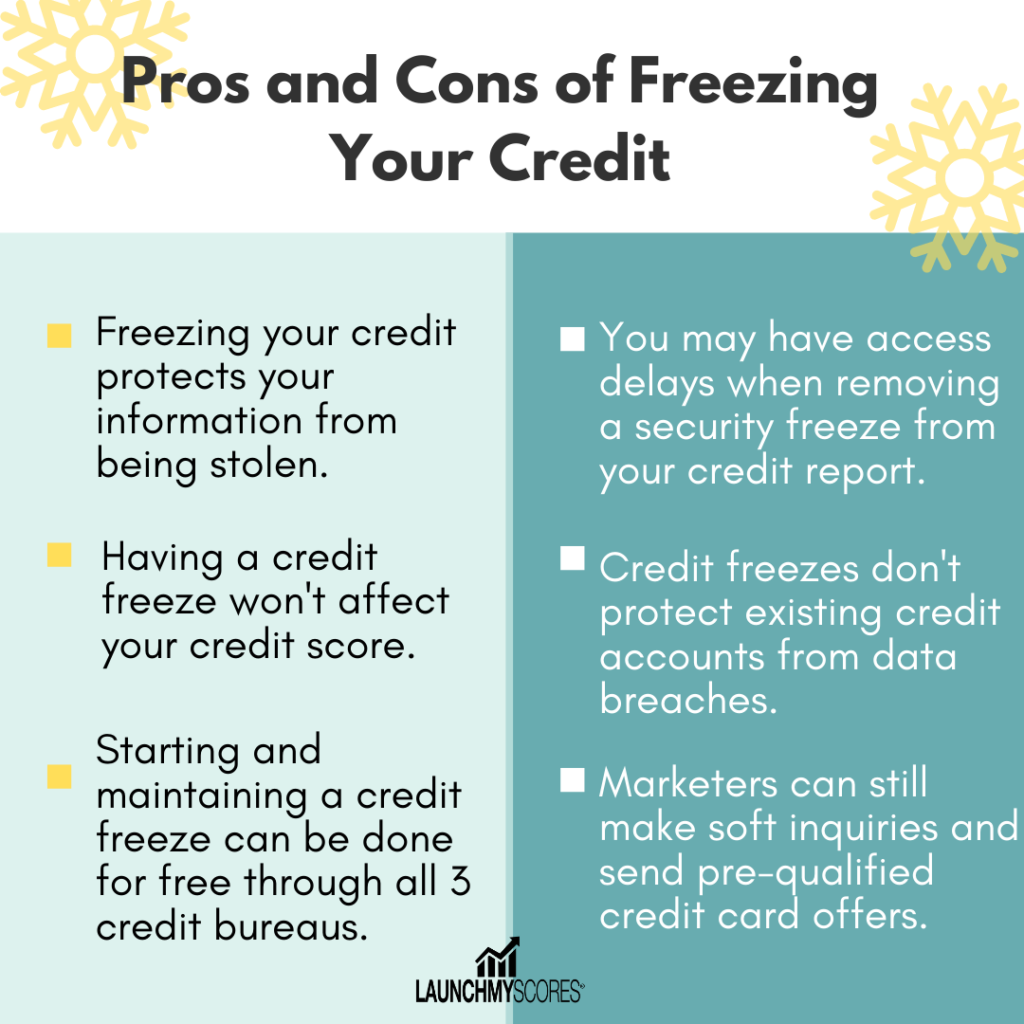

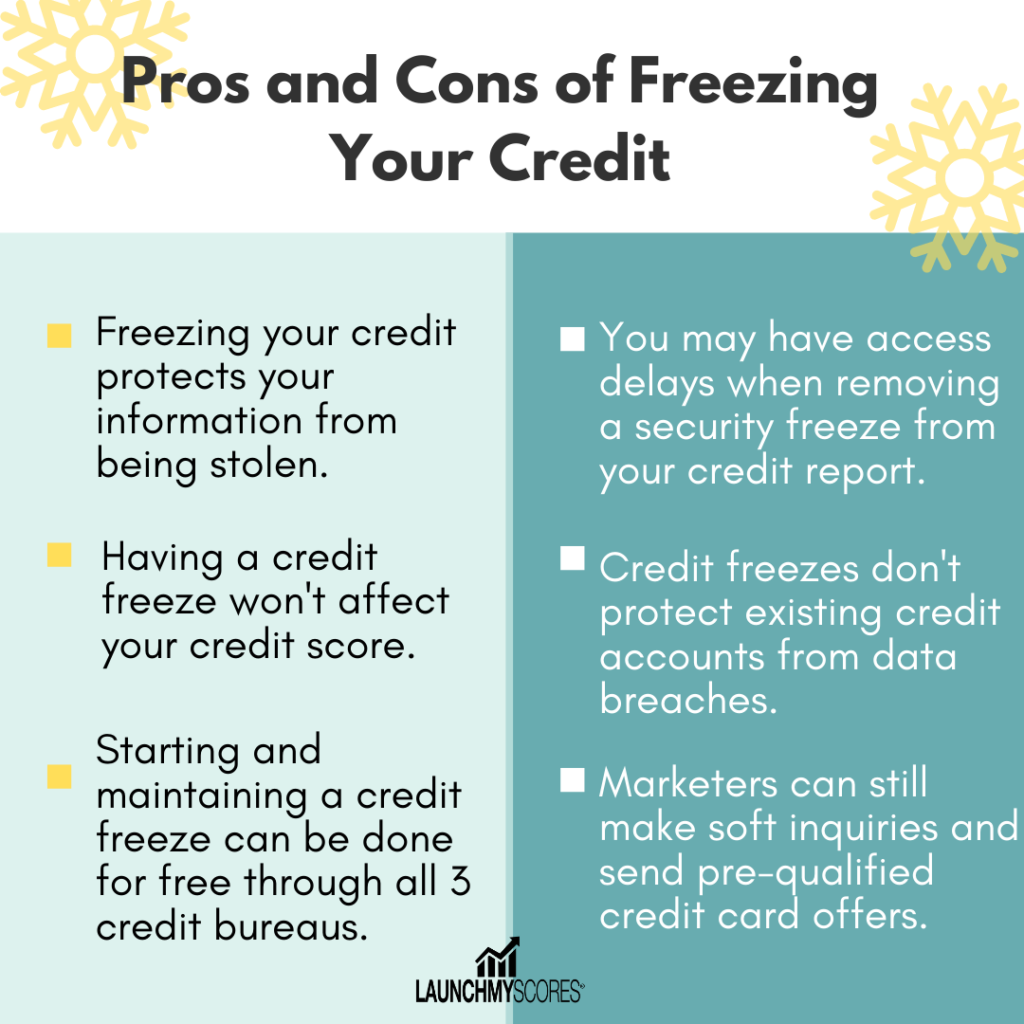

You’ll need to temporarily unfreeze if you want to get a new credit card, mortgage or, like me, lease a car. Like everything else in life, a credit freeze offers no 100% guarantee. And even if you freeze each of the big three, there are many small and specialized credit bureaus – it was through one of these that an identity theft was perpetrated against one of my survey respondents. Some people consider it a hassle, because you have to contact each of the three major credit bureaus individually. You still need to be vigilant in checking those accounts to make sure you made all the transactions. A credit freeze doesn’t help protect against fraud aimed at your existing accounts. Your existing accounts are unprotected.īut that does lead to the first of four downsides: Perhaps it should be called a “new credit freeze” because by closing off access to your credit report, credit freezes effectively prevent new accounts from being created. What had shocked me in my survey results was that so many people incorrectly thought that a credit freeze would somehow make it difficult for them to use their own existing accounts, such as their credit cards! Not true. In another case, a fraudster submitted a tax return requesting a large refund in my friend’s name, and only by sheer luck – he decided to file his real return early that year, leaving the IRS with two conflicting documents – did he avoid years of hassle and potential criminal charges.Īs long as you keep careful, secure records of your passwords and PINs, the downsides of freezing your credit are, essentially, nuisance-level. Postal mail so that they could order and intercept credit cards for new accounts in the person’s name. Two of the identity theft victims in my survey told stories in which fraudsters put a hold on their U.S. My survey results also agreed with consumer advocates who say that preventing identity theft is more than worth the hassle involved in freezing your credit. 9 people (15%) made clear in written comments that they were confused about what a credit freeze is, its purpose, and how it differs from the various forms of credit monitoring, alerts, and locks. 5 of my respondents were victims of identity theft. Another 13 of the non-freezers used some form of credit monitoring, including credit locks. But 41 (69%) did not, of which 13 (22%) had never even encountered the concept of a credit freeze, much less asked whether or not they should freeze their own credit!. 18 people (31%) froze their credit – so my associates froze at a higher rate (nearly one in three) than the original survey’s one in five. The detailed responses, you see, exposed that so many people still are terribly confused about credit freezes. I was wrong – my results corroborated the Fundera-Wakefield finding. I sent 160 emails to a selection of friends and LinkedIn connections, asking “Have you ever frozen or locked your credit?” and a handful of follow-up questions about why or why not, and their experience if they had. So, I decided to do my own informal survey. So, for me, that one in five Americans with frozen credit didn’t sound possible.

In the two years since I froze my credit, I had yet to run into anyone else who had answered “yes” to the “Should I freeze my credit?” question. Finding the survey by Fundera/Wakefield Research stating that nearly one in five people froze their credit really floored me.

0 kommentar(er)

0 kommentar(er)